Knowledge hub

Problem

The risks associated with decentralized finance (DeFi) protocols are still largely undefined, leaving

investors uncertain about the level of risk they face when investing in these protocols.

One way to mitigate this risk is to purchase DeFi coverage, which would provide full compensation in the

event of a DeFi hack. However, the DeFi coverage, or “insurance,” market is still in its early stages. The limited number of

DeFi coverage providers, relatively low liquidity, volatile pricing, and high friction in the purchasing process make this

sector currently user-unfriendly.

What is the Global Risks Chain

Global Risk Chain is not another blockchain or Layer 2/rollup solution.

It is an infrastructure that connects all existing and future blockchain networks, unifying user

interactions,

rebalancing underwriting liquidity, and providing DeFi risk coverage.

Global Risk Chain serves as a single point of entry for users and investors who want to either cover their risks or provide

liquidity to earn yield.

What does Global Risks Chain enable

Global DeFi Risks Chain is an infrastructure that simplifies decentralized finance risk management.

It abstracts away the complexity of blockchains, making risk management chain-agnostic.

This allows a user-friendly experience when covering DeFi risks and earning yield.

The protocol enables wallets, tools, and services to easily integrate DeFi coverage into their offerings,

creating the first “embedded DeFi cover” solution. Behind the scenes, Global Risks Chain handles the

settlement of funds and liquidity across chains and protocols.

In summary, Global Risks Chain provides a streamlined and cross-chain approach to managing DeFi risks,

making it accessible to a wider audience of DeFi users and service providers.

Architecture

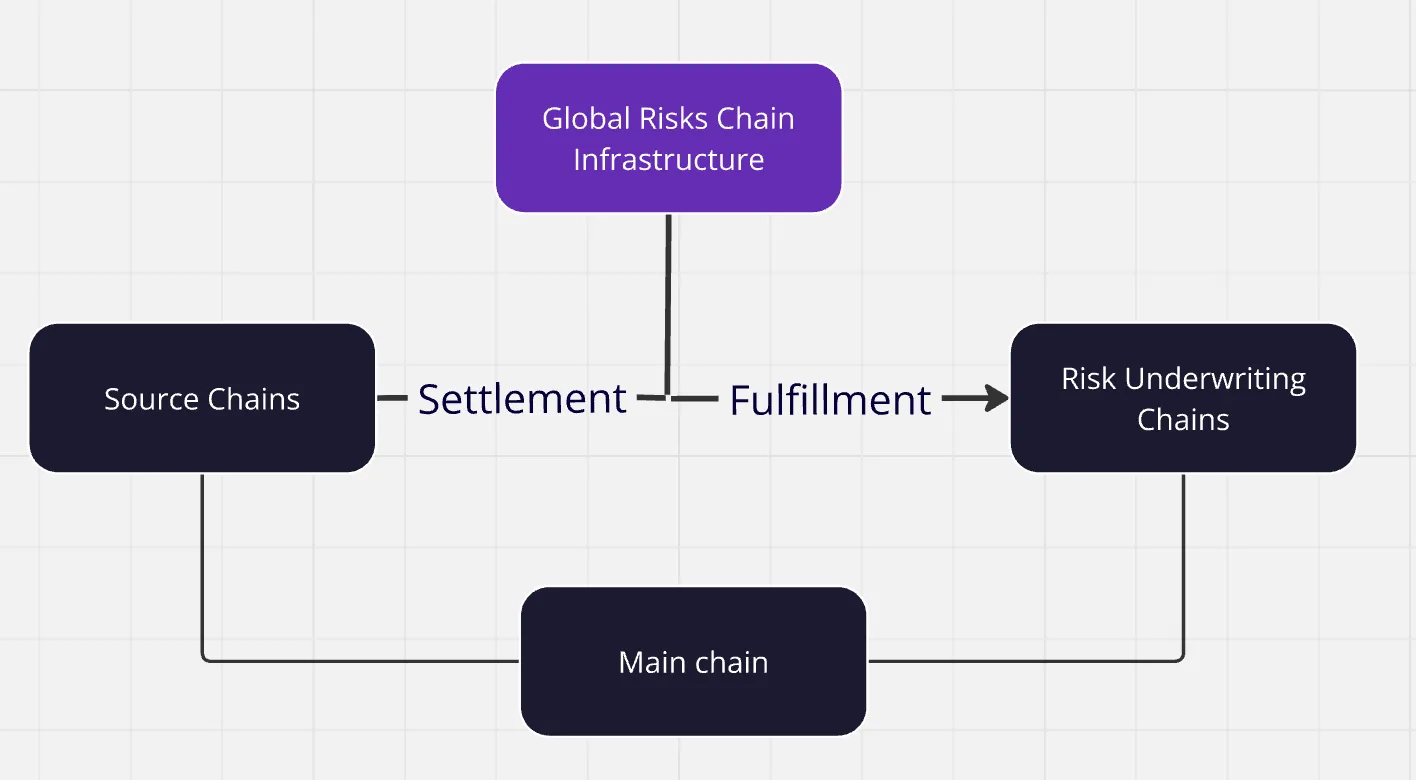

Global Risks Chain offers a unified user experience across multiple blockchains and risk management protocols. This Chain connects the liquidity and demand of various blockchains, allowing users to buy and sell risks on any supported chain without being tied to a specific chain or protocol. Each type of chain serves a distinct purpose:

- Source Chains: these are the chains where users interact with risk management solutions, such as purchasing DeFi coverage or underwriting DeFi risks.

- Risk Underwriting Chains: these chains hold liquidity in various forms. They may involve specific DeFi cover protocols (e.g., ‘DeFi Insurance’), lending protocols, or even decentralized exchange (DEX) liquidity.

- Main chain: this is the chain where the protocol registers holders, assets, claims, governance, and other essential assets.

- Global Risk Chain Infrastructure: this off-chain component orchestrates liquidity management, monitors risk prices, and identifies arbitrage opportunities

Transactions and settlement

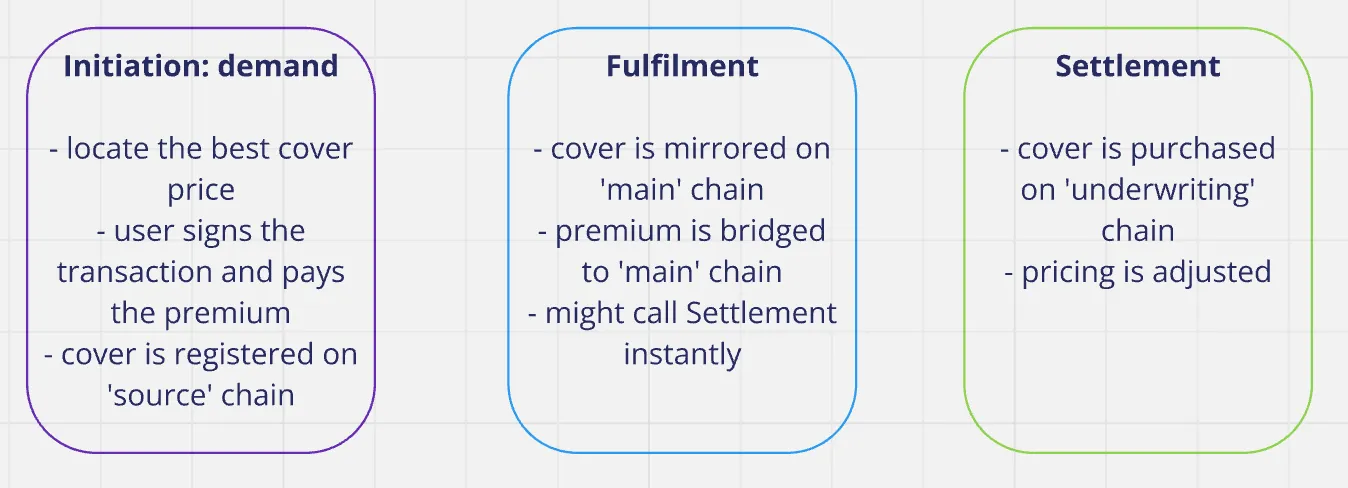

Each transaction initiated by the user will have 3 following steps, under the hood, like these for the ‘buy a DeFi cover’ example:

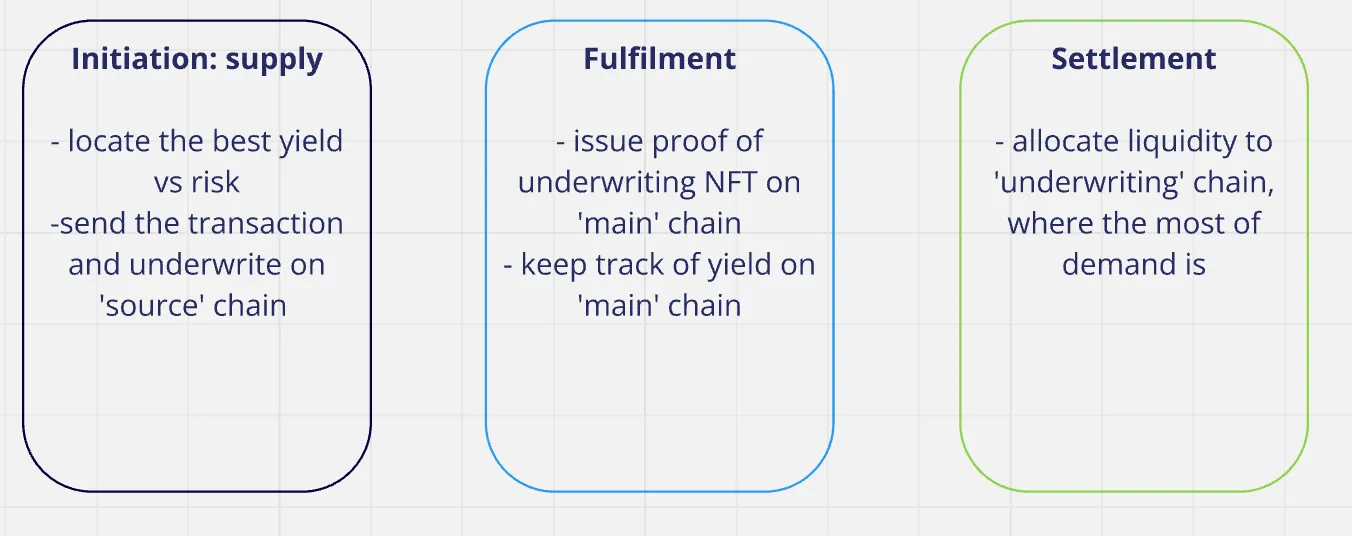

On the contrary, if the user wants to provide the liquidity and start earning from underwriting DeFi risks, this will happen:

Use cases, economic incentives and opportunities

The Global Risk Chain has the potential to create a new segment within Decentralized Finance (DeFi) with various use cases, including:

- Frictionless DeFi Coverage: Users can purchase coverage easily, with options for embedded and perpetual DeFi cover.

- Automatic Synchronization: Users’ cover capital and their DeFi exposure can be automatically synchronized, providing 100% insurance coverage, 24/7.

- Auditing: Individuals and projects can contribute to activities that reduce risk for protocols, such as code audits or security research. In exchange, they could be rewarded with the margin between the ‘actual’ risk and ‘market’ risk.

- Liquidity Provisioning: There are significant opportunities for providing liquidity on the chain for products that have the highest demand.

- Automatic Rebalancing: Liquidity providers can take advantage of vast opportunities for the automatic rebalancing of their investments across different chains and pools.

- Risk Tokenization: There is potential to unify ‘risk’ assets through tokenization, which could create new opportunities for risk arbitrage and peer-to-peer (P2P) trading