Become an insurance liquidity provider and earn 15% - 25% APY

Stablecoin investment, maxspread and fractional loss in case of a claim.

Bear market proof. Curated and optimized strategy by the Bright Team.

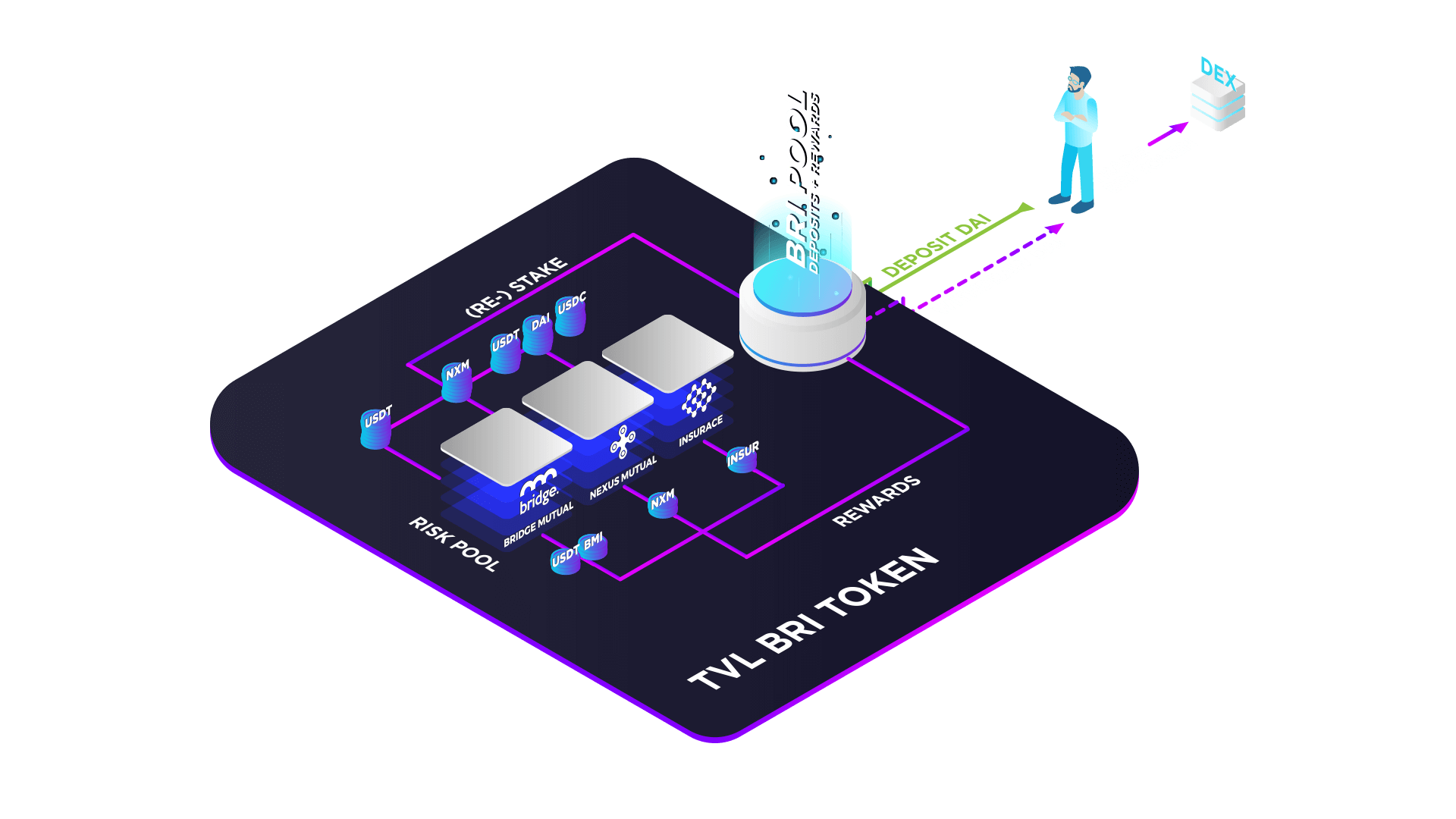

1. Navigate to Earn in the Bright Union App

2. Deposit stablecoin DAI in the Bright Risk Index (min. 1000 DAI)

3. DAI will be swapped to coin positions & staked in the underlying risk pools

4. BRI liquidity tokens are minted and send to your wallet

5. Congratulations, your capital is now accumulating rewards

6. The rewards will be re-invested in the risk pools

7. The strategy is optimized and rebalanced by Bright Union DAO

8. Take profits; withdraw from BRI pool or trade BRI on a DEX

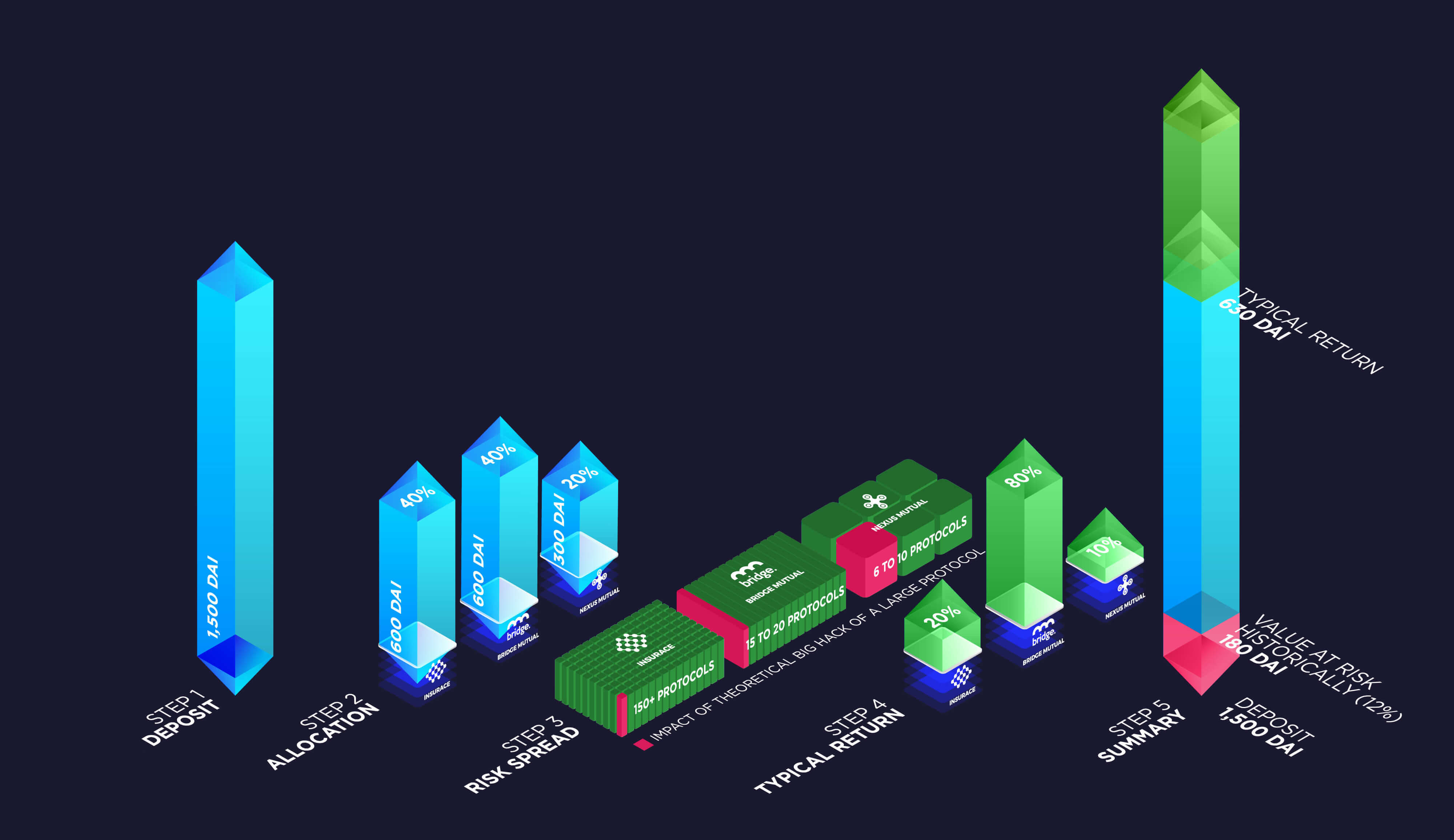

The investment strategy is curated and optimized by Bright Union DAO. This convenience is a key reason for users to invest in the Bright Risk Index. Because the investments in the risk pools are dynamic a set of investment principles is established which take into account 4 parameters:

Return - The APY of individual pools is driven by the popularity of its cover. Capital will be allocated to pools where capacity is wanted.

Stablecoin preference - Whenever possible the investment in risk pools will be made in stablecoins as not to expose our investors to FX risk.

Diversification risk platforms and protocols - A guiding principle is that the value at risk is targeted to be below 12% for any claim. To do this, the assets will be spread across risk pools of multiple insurance platforms

Protocol Risk - Bright Union will do an assessment of the quality of the insured protocol’s (code quality, extend of decentralization, past claims)

Based on the above parameters the launching investment strategy will invest ~40% of capital with InsurAce, 40% with Bridge Mutual and 20% with Nexus Mutual.

Take part in the collective growth of connected decentralized insurance.